| Home | About Us | Resources | Archive | Free Reports | Market Window |

GET ON IT! You've Almost Missed It in Florida Real EstateBy

Wednesday, December 5, 2012

Get on it, if you haven't already!

Because if you don't get on it right now, you'll miss it.

Don't get me wrong – you can still make great money here. Housing in Florida is still attractively priced. And I expect it will rise in price faster than just about anyone expects over the next decade. Even paying market price today is a great deal, as I will explain in a minute.

But I'm not talking about buying at market price. I'm talking about buying real estate below market...

I've been urging you to do this – no, beating you over the head telling you to do this – for a while now. I sincerely hope my message has gotten through.

I've been taking advantage of below-market deals... I bought one large property for 90% less than what it was under contract for in 2008. (I received an offer of twice what I paid for it a couple weeks later... and I turned it down!) And just last month, I bought a beach condo for about half of its CURRENT market value.

I knew the window of opportunity for below-market deals wouldn't last forever. But I didn't expect the end would arrive this fast...

Up until a few months ago, banks had to find someone to buy their properties – someone willing to take a risk. (The two properties I just described were previously owned by banks.) That's because nobody else would step up to buy them. That is changing – fast.

Buyers are back!

Big investors are just now arriving, and they're buying up everything. (The latest "buy" recommendation in my True Wealth newsletter is a company that has bought thousands of homes this year, mostly from banks and government entities.)

The latest numbers from my local area prove the buyers are back...

I live in northeast Florida. The Northeast Florida Association of Realtors just put out its latest numbers. And they are strong...

This creates the perfect recipe for higher home prices here in northeast Florida.

We have extremely cheap housing (median price of $137,950)... record-low mortgage rates (below 3.4%)... and extremely tight housing supplies, while demand is increasing.

The trend is up, too. One last factor is that the rent on a rental house beats the pants off interest on money in the bank.

And this isn't just happening in northeast Florida. The story is probably similar in your neck of the woods, too.

If you want to find a below-market deal, you'd better get out there and find it, now. The window of opportunity is closing fast.

I strongly believe you won't go wrong in the next few years... even if you pay market price for real estate. The thing is, YOU have to do it... You have to roll your sleeves up, get out there, and find your property.

So go! What's taking you so long? Get on it!

This is the best deal in the investment world today. Take advantage of it... now!

Good investing,

Steve

Further Reading:

Steve isn't the only one rolling up his sleeves and taking advantage of dirt-cheap real estate. Mark Ford has found a way to collect $1,250 every month from the government through his real estate deal.

And Brett Eversole is making offers on foreclosed homes and looking into becoming a landlord. It isn't for everyone, he explains. "It requires real work. But if you're ready to make it happen, you could earn an extra 7% 'dividend' every year," he writes. "That's a huge return in a near-zero-percent world."

Market NotesDOC EIFRIG WAS RIGHT! For readers who listened to Dr. David "Doc" Eifrig, it's been a good few years in health care stocks.

For several years now, Doc has encouraged readers to own shares of Big Pharma stocks. Doc notes how aging Baby Boomers will keep demand for drugs high... which will allow Big Pharma to keep paying big dividends. Many stocks in the sector pay yields of 4%-6%. We'll also note that "Obamacare" will produce extra demand for all types of health services... including Big Pharma's drugs.

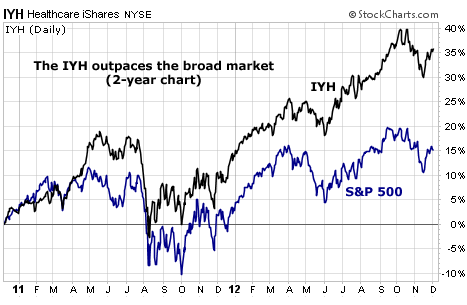

An easy way to track the price action in Big Pharma is the Healthcare iShares Fund (IYH). This health care fund has a huge weighting in Big Pharma stocks like Merck, Pfizer, and Abbott Labs.

As you can see from the two-year chart below, the market agrees with Doc's thesis. The chart plots the performance of IYH (black line, up 35%) versus the performance of the broad stock market (blue line, up 15%). The Baby Boom continues to make waves in the market.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|